Fundamental analysis of USD/JPY

Currently, the USDJPY pair is influenced by the intertwining of the Japanese financial management and the Yank fiscal barometers, as well as the statements of the Federal Reserve System.

In the Land of the Rising Sun, the Bank of Japan (BoJ) continues to take a soft stance. Asahi Noguchi, an authority among BoJ board members, stressed this, stating the need for the sovereign bank to steadfastly adhere to a liberal monetary regime to reinforce the continuous growth of remuneration, which is considered necessary for the monetary authority to reach the 2% inflation target. At the same time, Japanese Prime Minister Fumio Kishida has advocated higher wages, recognizing the favorable economic currents in his country. In the same vein, Bank of Japan Governor Kazuo Ueda declared the bank calm in maintaining a benign monetary policy, aiming for steady and unchanged inflation of 2% in tandem with wage growth. This strong advocacy of soft monetary policy by the Nipponese helmsmen is having a gravitational effect on the Japanese Yen (JPY), especially when compared to rising US Treasury bond yields.

On the other side of the Pacific, in the USA, the eyes of the financial conclave were fixed on unemployment figures and prevailing domestic trade. First and foremost, the unemployment data, as its impact on the Federal Reserve's employment estimates is enormous. The thundering data on rising jobless claims may have tipped the scales in the direction of a softer Fed stance, perhaps initiating a prolonged lull in monetary policy recalibration.

Nevertheless, the focus of market hawkers was the discourse coming from the Fed, especially after Chairman Jerome Powell's inaugural testimony to Congress. If there were no seismic deviations from Powell's first speech, the attention of the financial bazaar would have been directed to the oracles of the other Federal Open Market Committee (FOMC) consilers. Specifically, FOMC dignitaries Waller, Bowman, and Mester were invited to the podium. The market seemed to absorb the various forebodings of the FOMC delegates as rates for the July interest rate hike moderated.

In the grand finale, the symphony of the USDJPY duo is created by Japan's unwavering adherence to a "dovish" monetary strategy and the economic characters of the United States, combined with temperament and statements coming from the Federal Reserve. The Bank of Japan's steady dovish stance, backed by hawkish echoes from the Federal Reserve, could lead to a strengthening of the US dollar against the Japanese yen.

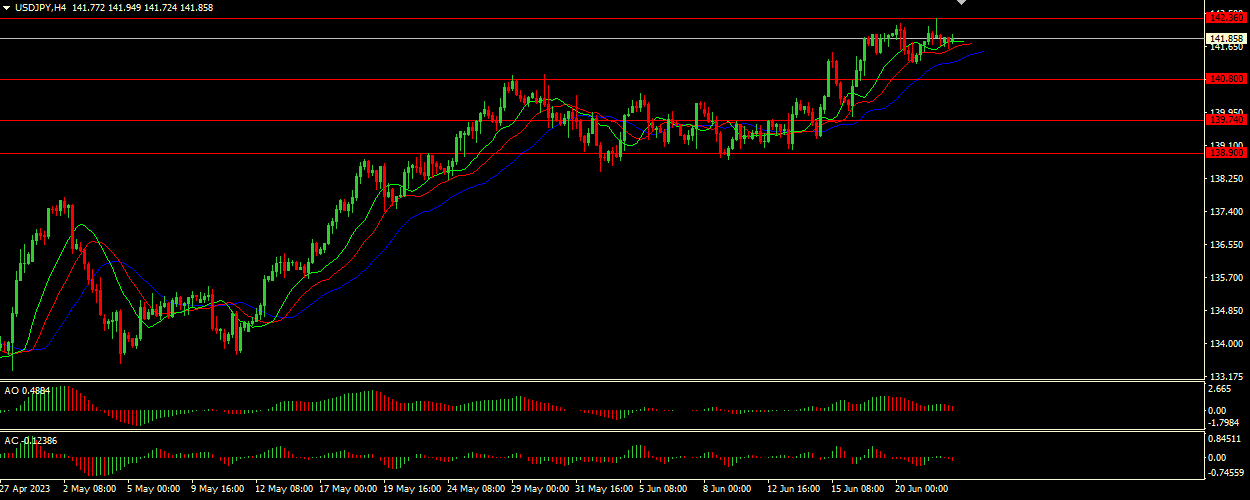

Technical analysis and scenarios:

Under the microscope of fundamental analysis, the USDJPY doublet could face stress factors generated by Japan's dovish monetary dogma and prospective hawkish impulses from the Fed. In addition, technical indicators point to an upward trajectory, albeit constrained by powerful retracement directives via the Awesome Oscillator (AO) and Accelerator Oscillator (AC).

Recommended entry level (BUY): 142.360.

Take Profit: 142.820.

Stop Loss: 142.000.

Recommended entry level (SELL): 142.360.

Take profit: 140.800.

Stop Loss: 142.820.