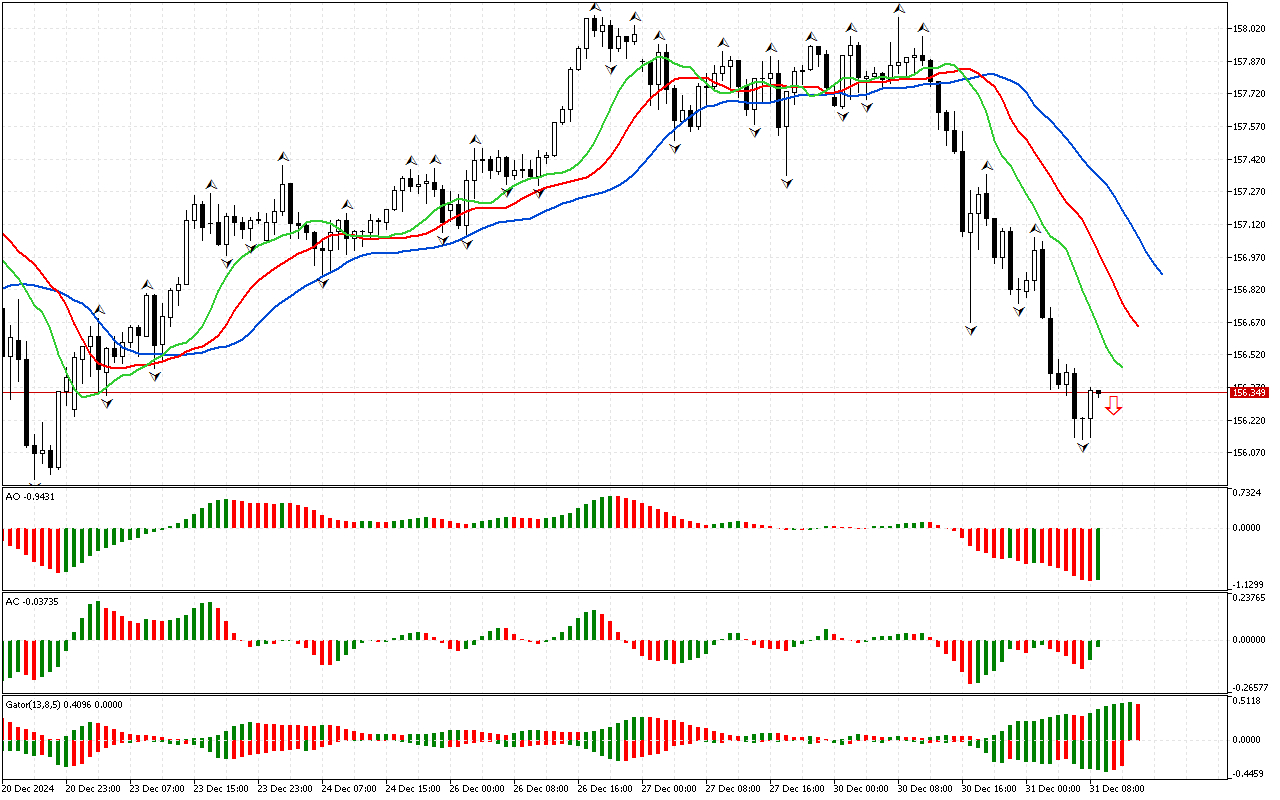

USDJPY H1: The Chaos Theory Forecast for the European Session at 31.12.2024

The Alligator confirms the signal of the first phase of the market: its mouth is open.

The Awesome Oscillator indicator has consolidated below the zero mark.

The histogram of the Gator indicator has not formed a clear signal yet. The color of the histograms changes, indicating a change in market phase.

As an epilogue to the analysis, the southern direction of price movement is noted to be considered as a priority. At the same time, the indicators contain signals about the possible development of a correction, which should be used to search for entry points at more beneficial prices.

📊 Sell Stop 156.131

❌ Stop Loss 157.133

After entering the market, Stop Loss is moved along the red line after closing each candle. The profit is fixed by moving Stop Loss, or when opposite signals appear on the AO, AC, Gator indicators.