Fundamental analysis of XAU/USD

There is a lot of speculation in the gold market as traders and investors focus on a number of influential economic indicators and central bank decisions. Gold prices remained stable in the market on Tuesday, with gold trading at 1987 levels. The recovery came after falling to its lowest level in three weeks.

Most investors pay attention to the Federal Reserve report and the US consumer price index. The Consumer Price Index was unchanged from last month and the annualized increase was 3%, indicating that inflation is slowing down. The Fed is expected to keep interest rates at 5.25-5.50% with the possibility of a cut in March-May. This scenario assumes lower unemployment and inflation. At the same time, with positive data on the labor market and a stable dollar, expectations of a rate cut in March will weaken, and the pressure will shift to May.

In addition, several central bank meetings are scheduled this week, including the European Central Bank and the Bank of England, which could have a significant impact on gold prices. In addition, geopolitical tensions in the Middle East are supporting gold as a safe-haven asset. However, the direction of XAU/USD is largely dependent on the US Dollar dynamics and future Federal Open Market Committee decisions.

Technical analysis and scenarios:

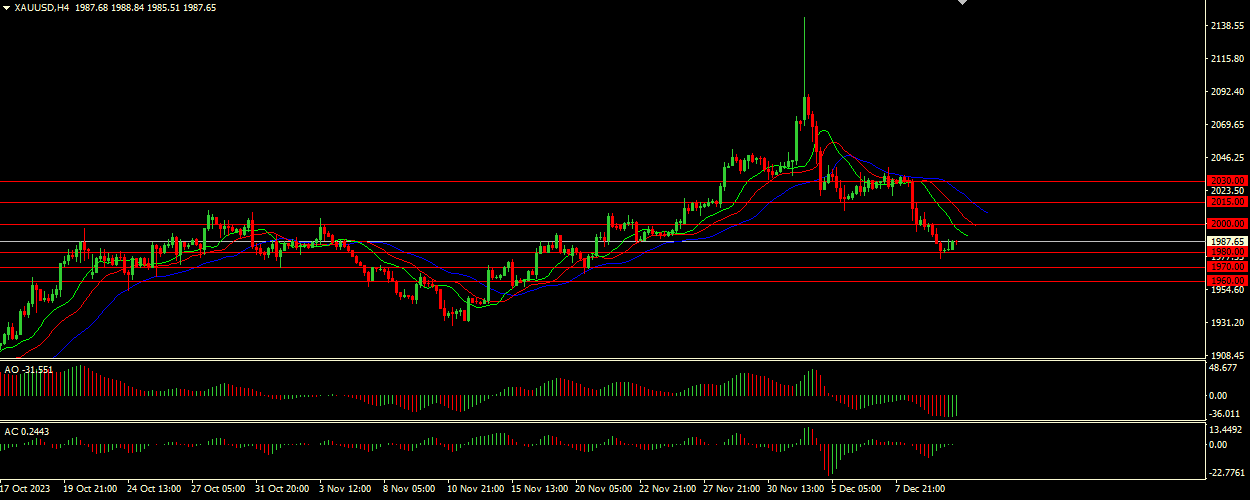

Given the conflicting signals (bearish from Alligator, bullish from AO and AC), there could be volatility in the market. If bullish momentum strengthens, price could overcome the immediate resistance at 2000.00, with the potential to advance towards 2015.00 or 2030.00. If bearish tendencies prevail, the price could retest the support levels of 1980.00, 1970.00 and possibly 1960.00.

Main scenario (BUY)

Recommended entry level: 2000.00.

Take Profit: 2015.00.

Stop loss: 1995.00.

Alternative scenario (SELL)

Recommended entry level: 1980.00.

Take Profit: 1970.00.

Stop loss: 1985.00.